Guaranteeing Stability: Trust Foundations for Your Building And Construction Demands

Reinforce Your Heritage With Expert Trust Foundation Solutions

Professional depend on structure solutions offer a durable framework that can safeguard your possessions and guarantee your dreams are lugged out precisely as meant. As we delve right into the nuances of count on structure solutions, we uncover the essential components that can fortify your tradition and provide an enduring influence for generations to come.

Advantages of Trust Fund Foundation Solutions

Trust fund foundation solutions offer a durable framework for guarding possessions and making sure long-term financial security for individuals and organizations alike. One of the primary benefits of count on structure services is property security. By establishing a trust, individuals can protect their possessions from possible threats such as legal actions, financial institutions, or unanticipated economic obligations. This security makes certain that the assets held within the count on stay safe and can be passed on to future generations according to the individual's desires.

With counts on, individuals can detail exactly how their possessions should be taken care of and distributed upon their passing away. Counts on additionally use personal privacy benefits, as properties held within a trust are not subject to probate, which is a public and typically extensive lawful process.

Kinds Of Trust Funds for Tradition Planning

When taking into consideration legacy planning, a vital facet includes discovering different sorts of legal tools created to preserve and distribute assets effectively. One common kind of depend on made use of in legacy preparation is a revocable living depend on. This trust fund allows people to maintain control over their properties during their lifetime while ensuring a smooth transition of these assets to recipients upon their passing away, avoiding the probate process and giving personal privacy to the household.

One more kind is an irrevocable depend on, which can not be changed or withdrawed once developed. This trust fund provides potential tax obligation advantages and safeguards possessions from creditors. Charitable depends on are additionally prominent for people aiming to support a cause while preserving a stream of revenue for themselves or their recipients. Unique demands trusts are essential for individuals with specials needs to guarantee they get required treatment and assistance without threatening government benefits.

Recognizing the different kinds of counts on offered for tradition preparation is critical in establishing a thorough approach that aligns with specific objectives and concerns.

Picking the Right Trustee

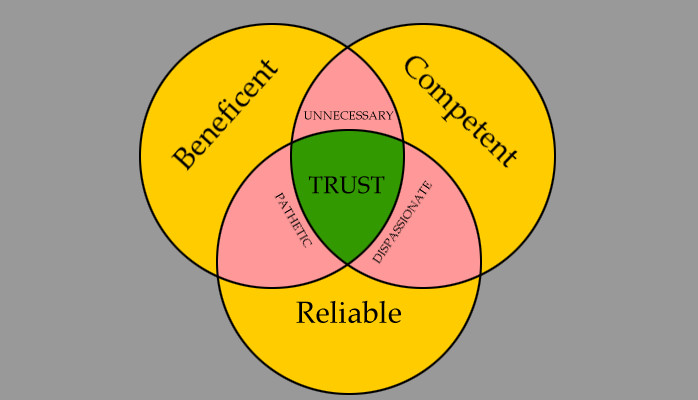

In the world of legacy planning, a critical aspect that demands careful factor to consider is the choice of a suitable person to satisfy the essential function of trustee. Picking the best trustee is a choice that can dramatically affect the successful implementation of a depend on and the satisfaction of the grantor's dreams. When picking a trustee, it is important to prioritize high qualities such as credibility, monetary acumen, stability, and a dedication to acting in the very best rate of interests of the recipients.

Ideally, the picked trustee should possess a strong understanding of monetary issues, can making audio investment decisions, and have the ability to navigate intricate legal and tax demands. In addition, effective communication skills, interest to detail, and a willingness to act impartially are likewise vital features for a trustee to have. It is suggested to select someone who is reputable, liable, and efficient in meeting the obligations and responsibilities related to the function of trustee. By thoroughly considering these factors and picking a trustee who straightens with the worths and goals of the trust, you can aid make certain the long-term success and preservation of your tradition.

Tax Effects and Advantages

Taking into consideration the fiscal landscape surrounding count on frameworks and estate planning, it is extremely important to explore the detailed realm of tax obligation effects and benefits - trust foundations. When establishing a depend on, recognizing the tax obligation implications is important for maximizing the advantages and decreasing prospective responsibilities. Counts on supply numerous tax advantages relying on their structure and function, such as decreasing estate tax obligations, income taxes, and gift tax obligations

One significant benefit of particular trust fund structures is the capacity to move assets to beneficiaries with decreased tax obligation effects. As an link example, unalterable trust funds can remove assets from the grantor's estate, possibly lowering estate tax obligation liability. Additionally, some depends on permit income to be dispersed to beneficiaries, that might remain in reduced tax brackets, leading to total tax financial savings for the household.

However, it is essential to note that tax laws are complex and subject to transform, stressing the need of speaking with tax obligation specialists and estate preparation specialists to guarantee conformity and maximize the view website tax benefits of trust fund foundations. Correctly browsing the tax obligation implications of trust funds can bring about significant savings and a much more efficient transfer of wide range to future generations.

Steps to Establishing a Trust Fund

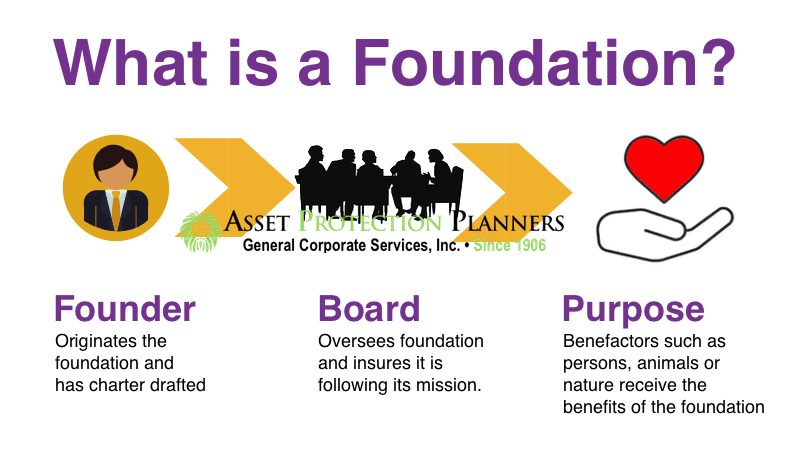

To develop a trust efficiently, precise interest to detail and adherence to lawful protocols are vital. The initial step in developing a trust fund is to clearly define the objective of the count on and the assets that will be consisted of. This involves recognizing the beneficiaries that will take advantage of the count on and appointing a trustworthy trustee to manage the possessions. Next, it is important to pick the sort of trust that best aligns with your objectives, whether it be a revocable trust, unalterable count on, or living trust.

Conclusion

To conclude, developing a depend on structure can supply various advantages for heritage planning, consisting of property defense, control over distribution, and tax obligation benefits. By selecting the appropriate sort of count on and trustee, individuals can secure their properties and ensure their dreams are executed according to their needs. Understanding the tax obligation Clicking Here implications and taking the necessary actions to develop a trust fund can help strengthen your legacy for future generations.